It’s been over a year since COVID-19 dramatically entered into our lives and it continues to disrupt the lives of the Australian community and all countries worldwide. What has been recognised amongst this chaos is the integral part that community pharmacy plays in the lives of the everyday person. So, before we get into the juicy details of the Budget, I just wanted to acknowledge the pharmacy industry and what an incredible job they have done in keeping our community safe and healthy over this difficult period.

So now on to the main course! Treasurer, Josh Frydenberg, delivered the federal Budget for 2021-22 on 11 May 2021. This Budget is important to understand as it was a windfall for the health sector and there are opportunities for you to look out for that could be made available to your pharmacy. Read on and let’s un-mask the important items you need to be informed about.

The Economy Landscape

The impacts of the COVID-19 pandemic have negatively impacted our economy and the Government is working to re-build the economy. In order to do this heavy investments and spending are required by the Government in order to stimulate growth again.

The following items summarise what the Government predicts for the economy and future:

· This Budget’s deficit is $106.6 billion and is expected to decrease to a $57 billion deficit by 30 June 2025. The net national debt is currently sitting at $729 billion and will continue to grow to $980.6 billion by 30 June 2025.

· Unemployment in 2021-22 is at 5% and expected to drop to 4.75% by 30 June 2023.

· Wage growth is expected to grow from 1.50% in 2021-22 to 2.25% by 30 June 2023.

· Inflation (CPI) at 2021-22 will be 1.75% and is estimated to increase to 2.25% by 30 June 2023.

Highlights of the 2021-22 Federal Budget

Chartered Accountants Australia and New Zealand have summarised the budget highlights. Please refer to ‘Resources’ below for further details.

What the Government is Doing for Health

Again, on top of the agenda is more funding and investments into the overall health sector. The Government plans to invest $121.4 billion in 2021-22 and around $503 billion over the course of the next four years. Since the March 2020 COVID-19 pandemic, $25 billion has been put towards the COVID-19 health response.

There were a few big wins for the health sector including aged care, mental health and also a commendable recognition to women’s health services. It is estimated that the pharmacy workforce is made up of more than 60% being women and the Pharmacy Guild has wholeheartedly supported this initiative to support our women in pharmacy and women across the country.

The overall breakdown of highlights into the health sector includes:

· Continuing from the previous Budget, $125.7 billion to be rolled forward of which $6 billion will be used to maintain the ongoing commitment to guarantee Medicare for all Australians.

· An extra $17.7 billion injected into aged care which will be used to help establish the five pillar as requested by the Royal Commission on Aged Care Quality and Safety. The pillar is a five year plan to ensure genuine changes are made for the elderly. This is a record investment into aged care however the Guild notes the disappointment of the Government overlooking their proposal to help at-home aged patients for pharmacists to supply dose administration aids to the elderly patients.

$29.9 million investment in the preparedness and capacity of the National Medical Stockpile, to allow health and aged care workers to access personal protective equipment.

· $2.3 billion investment into the National Health and Suicide Prevention Plan which is a record investment into the Commonwealth’s mental health system. There are different initiatives in this plan however one of the exciting ones will be to create a national network of 57 additional mental health treatment centers and satellites for adults, youth and children.

· $535.9 million for women and girls. Critical investments are required per the National Women’s Health Strategy 2020-30 in which much needed support are required for women who are suffering from or at risk of endometriosis, preventing premature birth, detection and treatment for breast and cervical cancer, mental health and for people with eating disorders and their families.

$781.1 million to prioritise Aboriginal and Torres Strait Islander health and ageing outcomes.

$135.4 billion in public hospitals for continuous funding under the 2020–25 National Health Reform Agreement (NHRA) and the National Partnership on COVID-19. This record level investment will be made available over five years.

$6.7 billion over four years for life-saving and life changing research of which $228.1 million new grants and programs will be available.

· $1.9 billion towards the vaccine rollout regime. Community pharmacy will remain a part of the Government’s COVID-19 vaccination initiative to deliver vaccinations amongst the GP and pharmacy networks to the Australian community. Pharmacies will be involved in the Phase 2 and 3 of the vaccination rollout of which $35.8 million has been put towards the temporary community pharmacy program.

· A further $3.9 million investment towards Take Home Naloxone pilot program for only another 12 months. This program is currently running through NSW, SA and WA.

$169.8 million towards access to safe services, medicines and up-to-date information on COVID-19. This includes $87.5 million to support GP-led Respiratory Clinics treat patients, $11.5 million to deliver the Home Medicine Service, and $7.1 million to ensure mental wellbeing service support through Beyond Blue.

$43 billion over the next four years to be put towards making medicines available and affordable to the community. For those wondering about the PBS schedules, the new and recent items to be added are:

Business Owners and Individuals

Temporary Full Expensing Extension

Businesses that have an aggregated turnover of less than $5 billion will be able to access the instant asset write off by fully depreciating eligible assets costing up to $150,000. This write off is available for new and second hand assets acquired 7:30pm (AEDT) 6 October 2020 all the way through to 30 June 2023. Assets must be first used or installed ready for use by 30 June 2023.

This was originally to end on 30 June 2022 however the Government has announced a further 12 month extension in order to support businesses with a longer-term project or where there has been issues with supply chains due to the impact of COVID-19.

Company Relief Measures

Last year the Government announced a Temporary Loss Carry Back measure where the tax losses can be offset against previous profits where tax was paid in the 2018-19 or later income years and the franking account does not go into deficit. This has now been extended for a further 12 months up to 30 June 2023.

Companies with an annual aggregated turnover of up to $5 billion will be able to access this relief measure. This will allow cash flow support to businesses by generating a refund back to them. The Government is encouraging and hoping businesses will use this relief to put it towards future investments.

Individual Tax Rates

The intended tax rate changes announced in previous Budgets were not supposed to take place until 1 July 2022 however it has now been brought forward to the 2020-21 tax year. In this Budget, the Government has announced the income brackets for the $18,201-$45,000 and $45,001-$120,000 groups to be altered for the relevant tax rates. Those in this income tax brackets will notice this when they lodge their 2021 tax return.

The Tax Institute summarises the current legislated tax rates and highlighted the brought forward changes. .

Medicare Levy Low Income Threshold

The Government has announced they will increase the Medicare levy low income thresholds for singles, families, seniors and pensioners due to recent changes in consumer price index. Medicare levy is paid by taxpayers where their taxable income exceeds threshold. The new threshold will apply from 1 July 2020 and Medicare levy is not applicable if they do not exceed the following threshold:

Please Note: For each Dependent or Student, the threshold will increase to $3,597 per addition (previously $3,533).

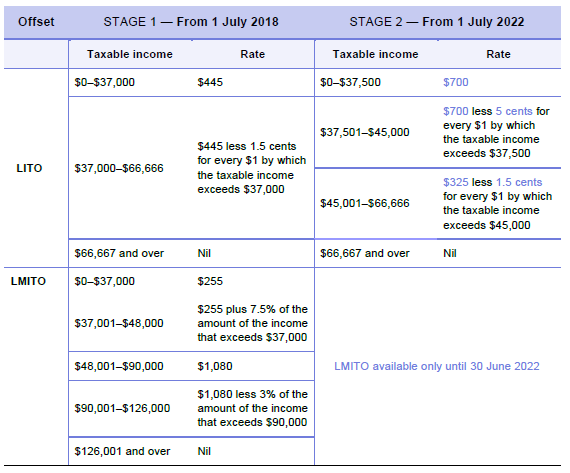

Low Middle Income Tax Offset (LMITO)

The LMITO is a tax offset to reduce the amount of tax payable for taxpayers with taxable income of less than $126,000. The Government has extended the LMITO for a further 12 months and will be last made available for the 2021-22 tax year.

The Tax Institute summarises the extension of the LMITO and changes to the Low Income Tax Offset from 01 July 2022.

Child Care Subsidy (CCS)

The Government wants to make childcare more affordable for parents and to boost the workforce participation and therefore it was anticipated changes to the Child Care reform was going to be happen. What the anticipated changes will bring:

· The CCS rate to increase by 30 percentage points for the second child and subsequent children aged five years and under in care, up to a maximum CCS rate of 95% for these children, commencing on 1 July 2022; and

· The CCS annual cap of $10,560 per child per year will be removed commencing on 1 July 2022

The Tax Institute shows current Child Care Subsidy Rates

The Tax Institute summary of estimated benefits to the changes

Self-Education Expenses

Current legislation exempts the first $250 of eligible self-education expenses as a deduction. This unusual tax law has been around since the 1970’s and the removal of this item will commence the financial year once Royal Assent has been granted on this legislation change.

Superannuation Measures

The three main outcomes from the Federal Budget relating to super are:

1. Work Test Abolished: Individuals aged 67-74 will no longer be required to meet the work test to make superannuation contributions from 1 July 2022. The work test currently requires the individual to be gainfully employed for at least 40 hours in a period of no more than 30 consecutive days in a financial year. This will allow more flexibility to those individuals who wish to remain working.

2. Downsizer Extension: It is estimated only about 22,000 households have taken up this measure to downsize their homes. The Government has found this has only had limited success, so are lowering the age to gain this tax measure from 65 to 60 as at 1 July 2022. This means, households can contribute up to $300,000 per person to their super fund if they sell their home which they have owned for at least 10 years.

3. Minimum $450 threshold abolished: Currently superannuation guarantee is paid to employees if they are earning more than $450 per month. The removal of the threshold will mean contributions will be made to most employees for the well being of their future retirement, especially women with lower income. It is likely to take place 1 July 2022.

4. Super Guarantee Rates: The current 9.5% super guarantee is expected to increase to 10% at 1 July 2021 and eventually up to 12% by 1 July 2025.

I bet that was a lot to digest! Please note there are other exciting Budget announcements which have not been mentioned. The items highlighted above are specifically tailored for our client base and their industry. Budget announcements still require to be put into legislation and given Royal Assent before any tax measures take place. If you think some of these items may impact you and/or your pharmacy, please consult your accountant before making any decisions. I always enjoy any feedback or commentary so please feel free to get in contact with me if you would like to discuss any Budget matters further.

Written by Victoria Le

Resources:

1. Australian Federal Budget 2021-22: https://budget.gov.au/

2. Department of Health: https://www.health.gov.au/resources/collections/budget-2021-22

4. AJP: https://ajp.com.au/news/budget-windfall-for-health/

5. Chartered Accountants Australia and New Zealand: https://www.charteredaccountantsanz.com/news-and-analysis/news/australian-federal-budget-2021-22-highlights-and-key-measures

6. The Tax Institute: Federal Budget Report 2021-22 dated 11 May 2021