Business ownership is a very emotive thing. We intuitively have a reasonable grasp of what is happening in our businesses from the day to day involvement, and from the conversations we have with our team. But as I have learnt, and other clients too, decisions based on emotion are rather dangerous. Sometimes what we think is happening is very different from what is actually happening. Politics, agendas, and biases come into play, often unintentional too. The best decisions are those back up by data and statistics. Data Analytics is a big part of modern-day business.

Good Data Means Good Decisions

The key to all this lies in your financial management systems and reporting framework. You know the saying…. garbage in garbage out. Poor systems produce poor data. I have seen in some partnership scenarios where doubt over the accuracy of the data, leads to indecision and reluctance to change. Anything that gets in the way of business evolving is not good.

So, getting your financial management systems tidied up so that it captures all relevant data efficiently and effectively must be an immediate priority.

Second to this is the reporting, producing a set of financial statements every month is a good start, but its not enough. Some of the most crucial data that governs the success of your pharmacy won’t be found within financial statements. That is why your monthly reporting frameworks not only include fully reconciled financial statements but should also include a 1-page KPI report. At minimum, this is what you should produce every month;

1. Monthly year to date Balance Sheet.

2. Monthly year to date Profit and Loss Statements.

3. Year to date this year versus last year Profit and Loss Statement.

4. One-page Key Performance Indicators.

Understand the Why?

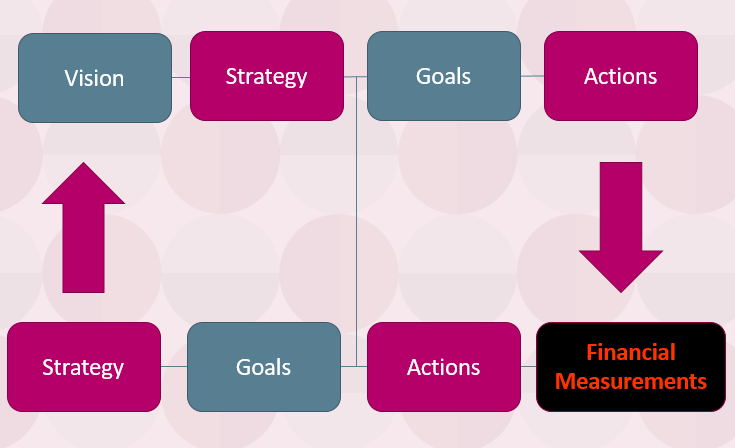

Most importantly, the types of KPI’s you measure, and track must be specific to your business and its own goals and vision. Your 3-year vision for your business, leads to specific strategies, which leads to small identifiable goals, which drive specific actions. Measuring the impacts of those actions is where your financial management systems and reporting framework and metrics come into play.

This leads to the concept of what you can measure you can manage, the crucial part of Key Performance Indicators;

1. Understand the key performance indicators that are the most relevant to your pharmacy and your vision.

2. Understand how they are calculated.

3. Understand what factors in your own systems and procedures influence these metrics.

4. Understand the trends.

5. Put actions in place to improve them.

For those who would like a copy of our guide to pharmacy Key Performance Indicators, showing the KPI’s that matter broken down into profitability, cashflow, liquidity, debt management and marketing, how they are calculated, industry benchmarks, and the main internal factors that influence each KPI then please click on the button below.

I won’t go into each KPI specifically here, but there is some commentary I would like to make.

1. They key activity drivers you must track, and influence are Customer numbers and Script numbers.

2. The evolution of community pharmacy has leads to changes in the data we track. Many years ago, sales used to be the main baseline. But the onset of price disclosure measures meant sales become irrelevant. Gross Profit dollars become the new baseline. But once again pharmacy is changing. There are new revenue streams which need to be measured as a baseline. Gross Profit plus Professional Service income. The rise of income streams from 6 CPA incentives plus customer paid professional services is becoming a bigger part of community pharmacy make up. This is the new baseline.

3. Some KPI’s such as GP Margins, Wages ratios are very much influenced by your particular brand. So be careful you are matching like for like when comparing to industry benchmarks. For example, a 777 is very different to a DDS.

4. Don’t forget to track those KPI’s that measure your cash flow cycles. We find the best one here is the Cash Conversion Cycle, which measures the timing of cash outflows from paying suppliers, versus cash inflows from the sale of stock. For the average pharmacy this is plus 30 days. Meaning the cash is going out 30 days before the cash is coming is. This has significant implications and important you understand this.

5. Marketing KPI’s are often forgotten about. Yet if you think about it, are some of the most crucial. Sales drive Gross Profit dollars. Customer numbers and script numbers drive sales. Marketing and community engagement drive customer numbers and script numbers. Marketing is all about data as well. Measure it and track how well you are engaging with your community.

In summary these are the key take outs for you;

1. Review your bookkeeping systems – the success of the KPI regime lies in the accuracy of the financial data and the systems employed to capture this data.

2. Regular monthly reporting – your financial management systems should allow you to have fully reconciled financial statements and a 1-page KPI report every month.

3. Know what factors influence each KPI.

4. Be responsive to trends – the best owners I know track this data and are responsive to any adverse trends that appear in their stores. Do something about it.

If you are in a lather about all this, and your existing financial management systems are, let’s say, struggling. Allow Peak Strategies undertake a review of your system and we can help you get it all back into shape and producing the data you need.

Written by our Director John Thornett