Labour Treasurer, Jim Chalmers’ has released the 2024-2025 federal budget, focusing again on easing cost-of-living pressures, cheaper medicines, investing in Australian manufacturing and critical minerals for the clean energy transition.

Although a quiet budget in regards to tax-related matters, we were pleased to see the Government recognising the role community pharmacies play in Australia and working together to provide access and care to medicines. Below are a few key points that we think are relevant to you and your pharmacy.

Community Pharmacy

There were many ‘wins’ announced as part of the federal budget for community pharmacy, being $3 billion in extra community pharmacy funding. As part of the budget announcements, we now know some details of the highly anticipated new five-year 8CPA to be effective from 1 July 2024.

Some include:

$3.4 billion over five years for new and amended listings on the PBS, including treatments for heart disease and breast cancer.

General patient’s co-payment to freeze at $31.60 until 1 January 2026.

A five-year freeze ($7.70) for pensioners and concession cardholders, from 1 January 2025 and the $1 discretionary discount to be removed.

Increasing the maximum number of Government-subsidised Dose Administration Aids – or Webster-paks provided by a pharmacy from 60 to 90 per week.

Other welcomed budget measures include:

Access to the Closing the Gap PBS Co-payment Program will be broadened ($11.1 million over 5 years) to support eligible First Nations patients to access free or more affordable PBS medicines wherever they fill their scripts.

$142.2 million to be invested to support for the expansion of the National Immunisation Program Vaccinations in Pharmacy Program, to allow pharmacists to administer vaccines in residential aged care homes and residential disability services.

Indexation of payments under NIPVIP to be in line with indexation of the Medicare Benefits Schedule from 1 July 2024.

24,100 additional home care packages for the 2024-25 will support more Australians to access in-home aged care and allow older people to remain independent in their home and community longer.

Small Business

The Government announced an additional temporary 12-month extension of the $20,000 instant asset write-off. Small businesses with an aggregated annual turnover of less than $10 million will be able to immediately deduct the cost of eligible assets costing less than $20,000 (instead of depreciating the expense over the life of the asset). These must be first used or installed ready for use between 1 July 2024 and 30 June 2025. It should be noted this is not yet legislated and neither is last year’s budget that announced the same measures for the 2023-24 financial year. This is a bit alarming as we are close to 30 June 2024 however it has been raised and currently in for review with parliament on 15 May 2024.

With that said, it is our view that the government should legislate a permanent increase to the instant asset write off threshold (and increase the aggregate turnover), instead of changing the eligibility requirements each year. This will allow small business to better plan and invest in their future.

Further to last year’s federal budget, the Government is addressing the continued rise in energy prices by extending the Energy Price Relief Plan for households and small businesses. $3.5billion will be provided over three years. Small businesses meeting the ‘small customer’ eligibility, will be able to receive a $325 annual rebate.

Individuals

Although previously announced on 25 January 2024, tax cuts for all taxpayers are enacted into law commencing 1 July 2024.

The 19% tax rate will be reduced to 16%.

The 32.5% per cent tax rate will be reduced to 30%.

The income threshold above which the 37% tax rate applies will be increased from $120,000 to $135,000.

The income threshold above which the 45% tax rate applies will be increased from $180,000 to $190,000.

To visualise and compare to the current tax brackets:

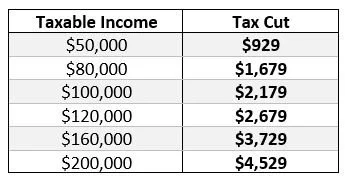

Under these changes, it means the below are the following tax cuts in dollar terms for individual taxpayers:

The Medicare levy low-income thresholds have also increased slightly to provide cost-of-living relief for taxpayers to be exempt for the 2% Medicare levy. of the current financial year 2023-2024. As of 1 July 2024, the new thresholds will apply:

*Family threshold will increase from $3,760 to $4,027 per dependent child

All Australian households are eligible for a $300 electricity annual rebate that will be applied in quarterly instalments from 1 July 2024.

Paid parental leave payments will be subject to 12% superannuation guarantee – a welcome measure to reduce the impact on retirement incomes for women, noting women make up around 61% of the pharmacy industry. This applies for births and adoptions on or after 1 July 2025.

HELP debt indexation capped – student loans will increase at the lower of the consumer price index or the wage price index and will be back-dated to all student loan balances as at 1 June 2023. The backdating is a retrospective change, meaning for all student loans which were indexed on 1 June 2023 at 7.1%, you’ll receive a credit of the difference between this high percentage and the reduced 3.2%. The ATO will automatically apply these adjustments. As with many other announced budget measures, this is not yet legislation however this will provide some relief for all pharmacy graduates so debts don’t continue to rise or remain stagnant.

In summary, we are pleased to see the Government continue to invest in community pharmacy and see the progress of the 8CPA agreement. Many of the announced measures not only support pharmacy business growth but is a step in the right direction to improve medicine accessibility, affordability, and patient care.