Tax legislation is forever changing. An important part of our client service is to ensure our pharmacy and small business owners are up to date on such changes, and that we implement the most tax effective strategies. The purpose of this blog is to highlight a few recent changes that may affect your business and overall family group taxes.

Division 7A Changes

Many pharmacy owners trade using a discretionary trust. Priya has recently written multiple blogs and has also presented at the WA Pharmacy Forum regarding s100A and the changes to discretionary trusts. S100A has affected many pharmacy owners and their tax planning strategies, which limit distributions to adult beneficiaries. So, if adult beneficiaries are not able to receive a distribution from a discretionary trust, why not distribute to a company, as a company only pays tax at 30%?

Many of you would already be aware of Div7A, however to refresh your mind:

Div7A is an anti-avoidance provision by the ATO to prevent directors and associates of a company ‘withdrawing’ money or providing credit, tax free ‘in the form of a loan’. This also applies for trusts which distribute taxable profits to a ‘bucket’ or ‘investment’ company.

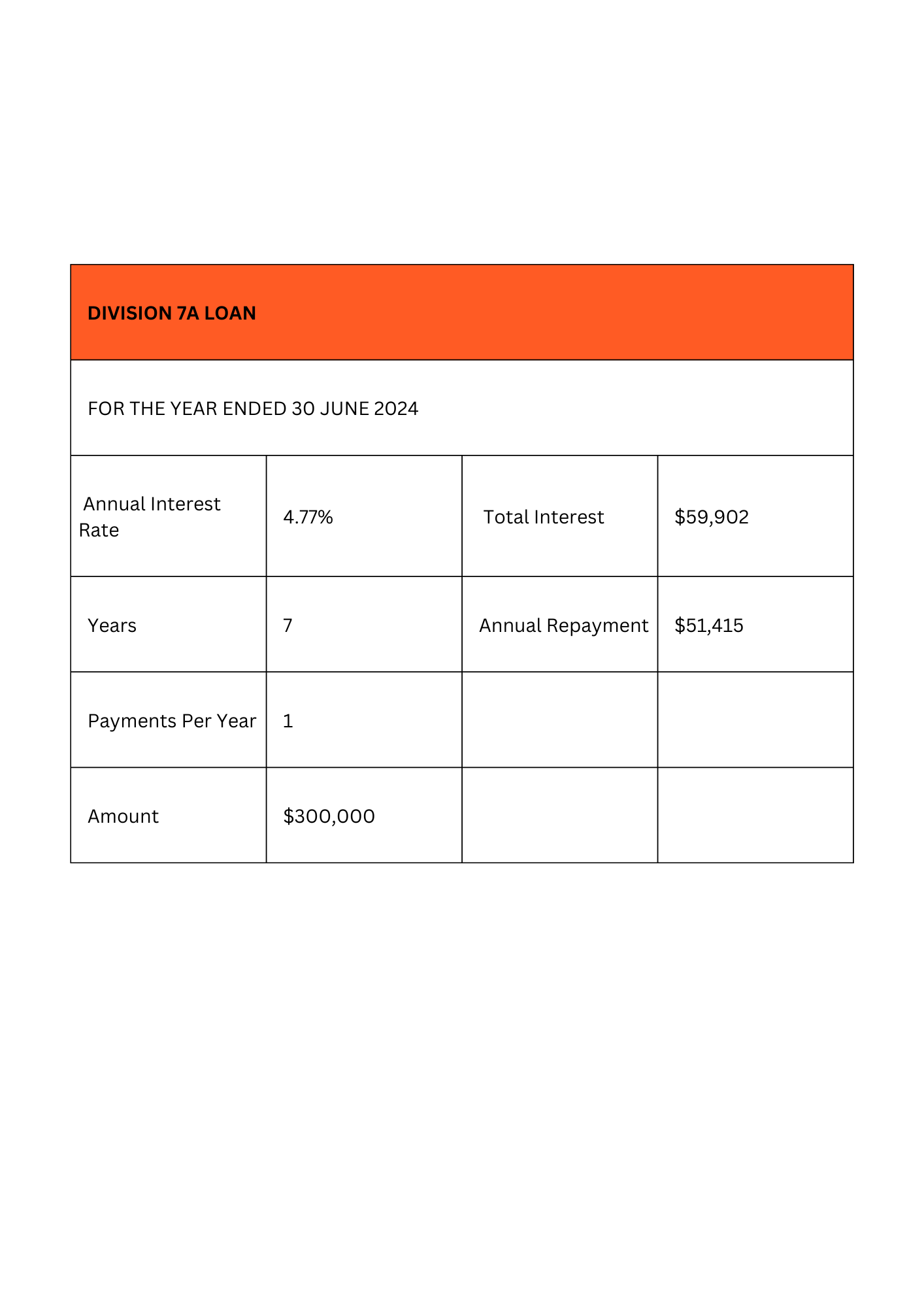

In short, if the loan is not repaid to the company in full by the lodgement date of the following year’s tax return, a Div7A loan arrangement will need to be entered. This loan is then required to be paid over 7 years plus interest, however, the ATO benchmark interest rate for these loans has increased on 1 July 2023 from 4.77% to 8.27%.

To illustrate the difference of this change, consider the following two scenarios, assuming no physical repayments are made (meaning only the minimum dividend required is declared):

Scenario 1: The total tax payable on the interest income for the company would be $17,971 (at 30% tax rate) and the deemed dividend for the shareholder will be $51,415 each year. This will be taxable at their marginal tax rate.

Scenario 2: The total tax payable on the interest income for the company would be $32,125 (at 30% tax rate) and the deemed dividend for the shareholder will be $58,155 each year. This will be taxable at their marginal tax rate.

As you can see above, as a result of the increase in the benchmark interest rate, an additional $14,154 of tax would be payable by the company over the term of the loan.

Now you may think, that may not be much, however many family groups may have historic Div7A loans or multiple loans over several years. It is important to consider making actual repayments towards such loans if cashflow allows or even better, utilising the company as an investment vehicle. Investing through the company effectively may result in:

- eliminate paying tax on the interest of the loan,

- eliminate having assessable dividend income as a result of meeting the minimum repayments requirement.

- having an investment in a tax effective entity that offers asset protection

- manage cashflow, Div7A arrangements require minimum repayments to be made by certain dates so a ‘staggered’ approach in transferring funds could also benefit you long-term.

Updates on Federal Budget announcements

A few months ago, I wrote a blog about some announcements made as part of the 2022-2023 Federal Budget. On 23 June 2023, the proposed additional 20% deduction for the ‘Small business skills and training boost’ and ‘Small business technology investment boost’ became law. So, what does this mean?

Small business skills and training boost

Small businesses can claim an additional 20% deduction, on top of their ordinary deduction, for expenditure incurred for the provision of eligible external training courses to employees by eligible registered training providers in Australia.

This measure currently runs until 30 June 2024.

The expenditure must be:

· for the provision of training to employees of your business, either in-person in Australia, or online

· charged, directly or indirectly, by a registered external training provider that is not you or an associate of yours (such as Pharmacy Guild trainings, Community Pharmacy Certificates etc.)

· already deductible for your business under taxation law

Training expenses can include incidental costs related to the provision of training, provided they are charged by the registered training provider, such as the cost of books or equipment needed for the course. The above measure is for employees only.

At Peak, we often talk about how your team is your greatest asset. Think about investing and upskilling your team members to maximise your patient experience and pharmacy services.

Small business technology investment boost

Small businesses can claim an additional 20% deduction, on top of their ordinary deduction, for eligible expenditure incurred and depreciating assets acquired, for the purposes of their digital operations or digitising their operations.

Eligible expenditure may include, but is not limited to, business expenditure on:

· digital enabling items – computer and telecommunications hardware and equipment, software, internet costs, systems and services that form and facilitate the use of computer networks.

· digital media and marketing – audio and visual content that can be created, accessed, stored or viewed on digital devices, including web page design.

· e-commerce – goods or services supporting digitally ordered or platform-enabled online transactions, portable payment devices, digital inventory management, subscriptions to cloud-based services and advice on digital operations or digitising operations, such as advice about digital tools to support business continuity and growth.

· cyber security – cyber security systems, backup management and monitoring services.

Unfortunately, this small tax measure ended for eligible expenses on 30 June 2023, however your accountant should factor these two additional deduction measures into the tax reconciliation part of your 2023 tax returns to reduce your tax liability.

With the ever-changing business environment and challenges the pharmacy industry faces, it is even more important to ‘review’ regularly. Review your business structures, review what investments are needed to facilitate future growth, review your financial data. Regarding Div7A, the ‘set and forget’ way of the past may not provide the most effective tax outcome, so it’s important you get in contact with your trusted tax advisor to discuss these issues.