Discover the Joys of the Festive Season

Can you believe it? We're fast approaching the end of another calendar year, and you know what that means - Christmas is just around the corner! For those who know me, it's no secret that Christmas is one of my favourite holidays of the year. With the holiday season knocking on our doors and our office and other businesses gearing up for our Christmas festivities, my mind wanders to the realm of entertainment expenses. The assumption often prevails that if you're spending money in the name of business, it should be tax-deductible, right? Well, let's delve into the nuances of making your entertainment expenses work in your business's favour.

What exactly are Entertainment Expenses?

Throughout the year, you may find yourselves providing your employees with food and drinks, gifts, and fun activities. These expenses all fall under the category of entertainment expenses for your business.

What falls under the category of Entertainment Expenses?

In the world of pharmacy and many other businesses, a wide range of expenses can be considered entertainment-related, including but not limited to:

Christmas parties

Gifts – Christmas, birthday, farewells, baby, appreciation gifts, etc.

Staff amenities

Morning and afternoon teas

Team lunches and dinners

Food and drinks provided during training

Bonus/rewards and recognition functions

Coffee and lunch meetings

What important aspects of Entertainment Expenses should I be aware of?

Despite appearing as straightforward deductions, entertainment expenses can significantly impact various tax items, including:

1. Deductibility:

In your accounts, entertainment expenses are deductible in your profit and loss statement if they're related to your business. However, the taxable deduction might differ.

2. FBT (Fringe Benefit Tax):

FBT is a tax paid by business owners for certain benefits provided to employees and family members, including current, future, and past employees. When dealing with entertainment expenses, it's essential to address these questions:

Who, What, When, Where, and Why - The critical factors in determining the legitimacy of entertainment expenses.

Exemptions - Some expenses may be exempt, such as the minor benefits exemption, applicable when the entertainment value is less than $300 GST inclusive per employee, and the expenses aren't frequent and irregular.

Records - Maintain meticulous records always to determine the correct tax treatment and for any audit purposes.

3. Income Tax:

Except when entertainment is subject to FBT, entertainment expenses are typically not tax-deductible. However, light refreshments provided on business premises for sustenance do qualify as deductible for tax purposes.

4. GST (Goods and Services Tax):

Claim GST only if FBT is applicable and if the expenses are income tax-deductible (e.g., light refreshments consumed on business premises).

Don't Be Disheartened; Reward Your Team Thoughtfully!

It's essential to remember that not all entertainment expenses are tax-deductible. However, that shouldn't discourage you from investing in your employees. Your team is an integral part of your business, and as a business owner, you may choose to reward and strengthen your team's bond to boost workplace morale. The decision to provide entertainment expenses for your business ultimately lies with your discretion.

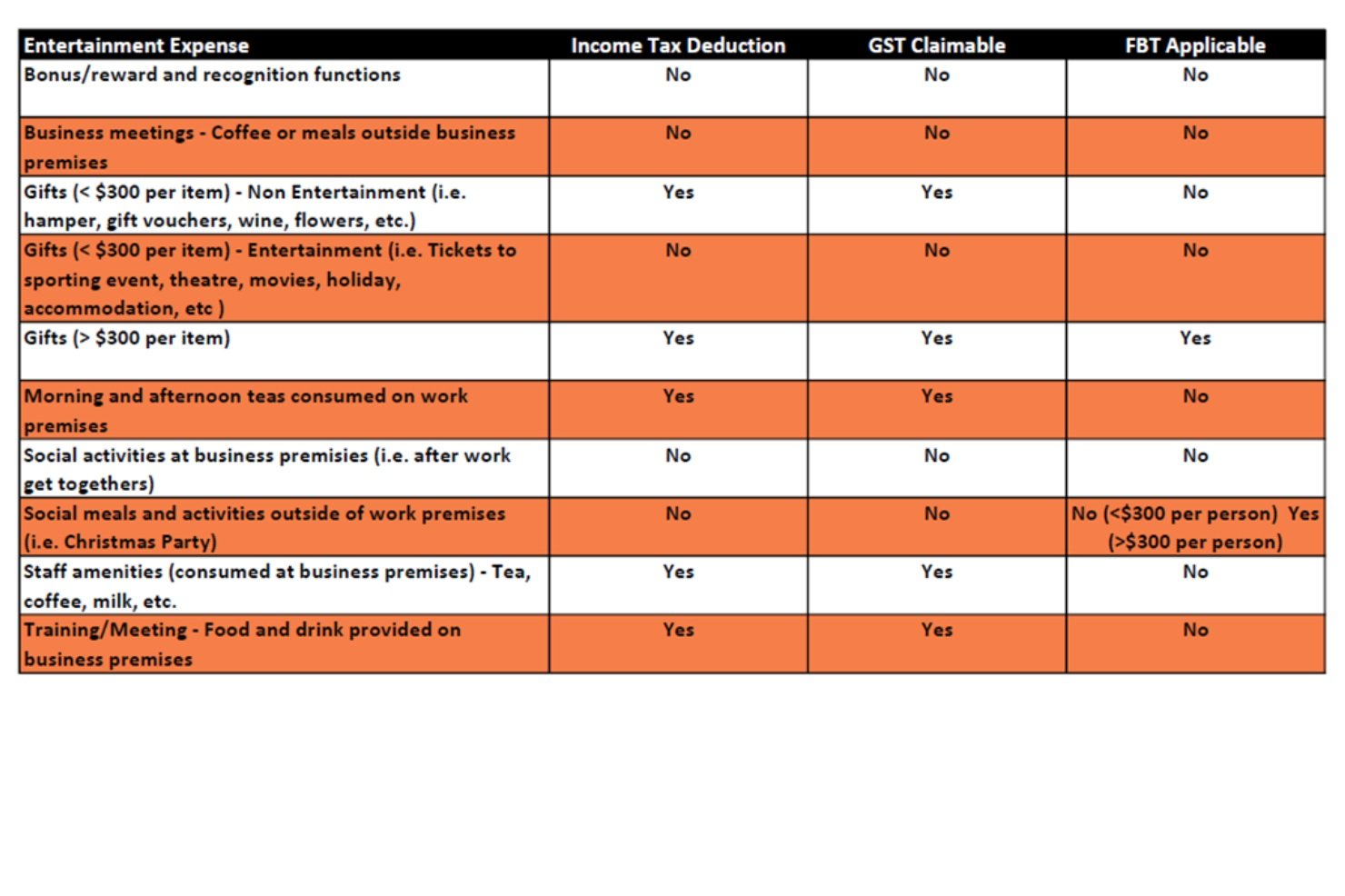

Feeling the early rush of Christmas cheer, I've put together a quick summary of common entertainment expenses and their tax-related treatment I have seen in pharmacy. As always, consult with your accountant if you have any questions concerning the correct treatment of entertainment expenses for your unique business.