As a pharmacist, you are qualified and well trained to help the community with their health needs and I think you do a fantastic job at it! Being the most accessible healthcare professionals in Australia, you are taking care of the needs of patients’ day in and day out.

So, when you become a business owner, how do you learn the business side of things? They certainly don’t have an unit to undertake in your university degree and it is not a requirement under your pharmacy internship. And where do you find the time to learn as well now that you are managing so many roles? Well, part of the answer is in this blog where I will guide you through the basics of reading your financial statements.

What are financial statements?

Financial statements are formal records of financial activities of a business or a non-trading business entity at a certain point in time. Similar to financial statements are your monthly management reports which consist of your balance sheet and profit and loss statement which you will need in order to assist you in preparing and lodging your Business Activity Statement (BAS) with the Australian Tax Office (ATO).

So, why is having a set of financial statements important?

Most commonly prepared by your accountant during tax time, it ensures your annual financial records have been reviewed to assist in preparing your income tax return for compliance with the ATO. Above all though, as a business owner you must have financial statements prepared on a monthly basis to help you understand the financial position of the business and its trading performance. You should be reviewing this regularly and using this data to assist you in planning and decision making. In addition to this, financial statements can be used in multiple ways, however, are most important if you:

- Require funding from the bank.

- Already have a loan with the bank. They will request this to ensure you are meeting the conditions of the loan.

- If you are intending to buy a pharmacy or purchasing into a partnership, you need to understand the financial information and what you are buying into.

- If you are wanting to sell your pharmacy, you need to understand how your business has been operating to ensure you are negotiating a reasonable sale price.

- If you require a valuation done on a pharmacy, a set of financial statements will be one of the requested documents that will need to be provided.

- To assist in making financial decisions or a tool used as a starting point to prepare future budgets.

What are the components of the financial statements should I know about?

Sole traders, partnerships, trusts and companies are the different types of entities that accountants prepare financial statements for. The most common items for these entities are:

1. Balance Sheet – Assets, Liabilities and Equity

2. Income Statement – Profit and Loss

I will now breakdown each of these items for you to understand so you have a basic understanding on how to read your financial statements.

Balance Sheet

A balance sheet is a record detailing the assets, liabilities and net equity of the business.

Assets: are items that add value to the business. It is made up of a mixture of assets that can produce cashflow and also, items that can’t be touched however does exist and has value. These are made up of:

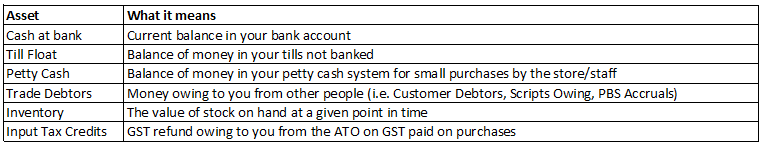

· Current Assets – are assets that are expected to convert to cash within 12 months.

Common Examples:

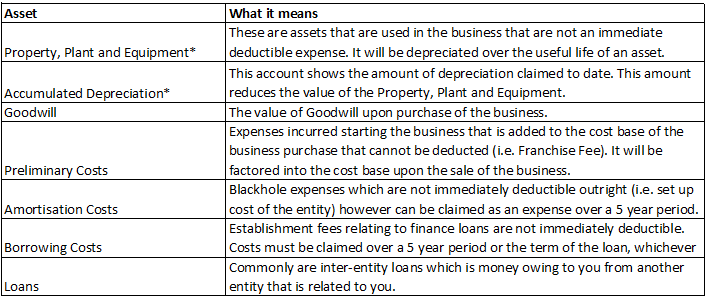

· Non-Current Assets – are assets that are not expected to convert to cash within 12 months or will take longer than 12 months to sell. These also includes assets that can’t be touched however do exist and adds value to the business (i.e. intangible items such as Goodwill).

Common Examples:

*These items should be recorded in the depreciation schedule which should be accompanied with your set of financial statements.

· Total Assets – Is the sum of current and non-current assets.

NOTE: Please be aware that assets should be shown as a positive. If this is in negative, it is a liability, except for Accumulated Depreciation.

Liabilities: are items that the business owes money to. These are made up of:

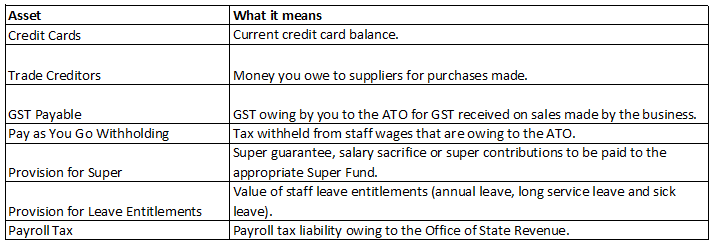

· Current Liabilities – obligations you are expected to pay off within 12 months.

Common Examples:

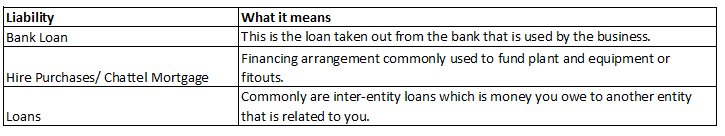

· Non-Current Liabilities – obligations you are expected to pay off in more than 12 months.

Common Examples:

· Total Liabilities – Is the sum of current and non-current assets.

NOTE: Please be aware that liabilities will show as a positive amount under the liability section. If it is in negative, it is an asset.

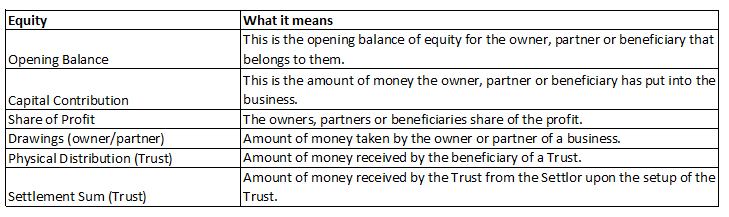

Equity: is the net worth of the business that belongs to the business owners, partners in a partnership and beneficiaries of a Trust. For a company, it details their retained profits and the capital shareholders have invested into the company.

Common Examples for sole traders, partners and beneficiaries of a Trust:

Common Examples for companies:

Income Statement/Profit and Loss Statement

This is to let you know the breakdown of earnings (net profit) of the business. It is usually broken down into:

1. Trading Account – Sales, Cost of Goods Sold and Net Profit.

2. Other Income

3. Expenses

Therefore: Net Profit = Trading Gross Profit + Other Income - Expenses

Trading Account: This shows the results of trading activities to determine the gross profit of the business and can be calculated as

Gross Profit = Sales – Cost of Goods Sold*

*Cost of Goods Sold = Opening Stock + Purchases – Closing Stock.

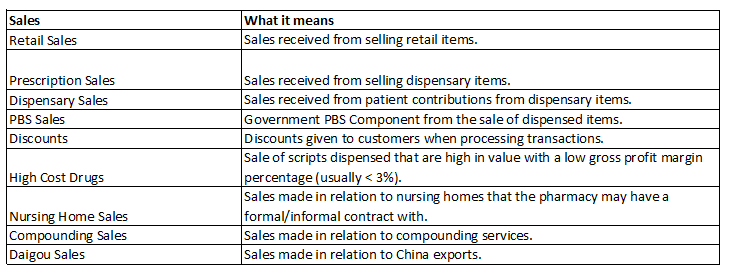

· Sales – are the gross sales received from your trading activities.

Common Examples:

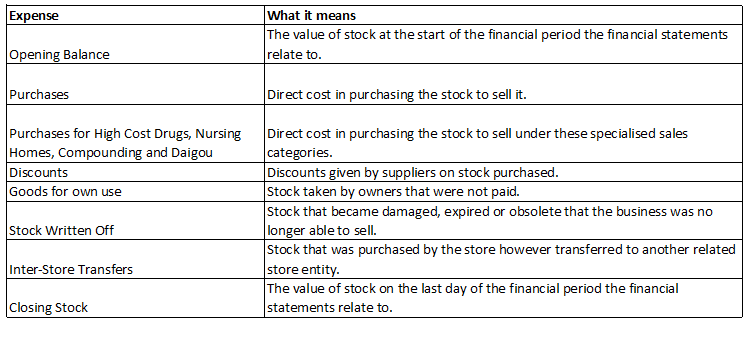

· Cost of Goods Sold – the costs directly attributed directly to the sale item.

Common Examples:

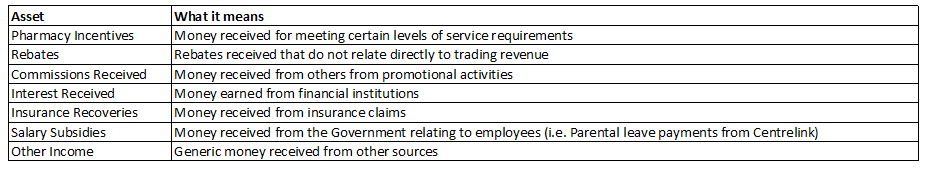

Other Income: This income is money received however does not directly relate to sales revenue received from trading.

Common Examples:

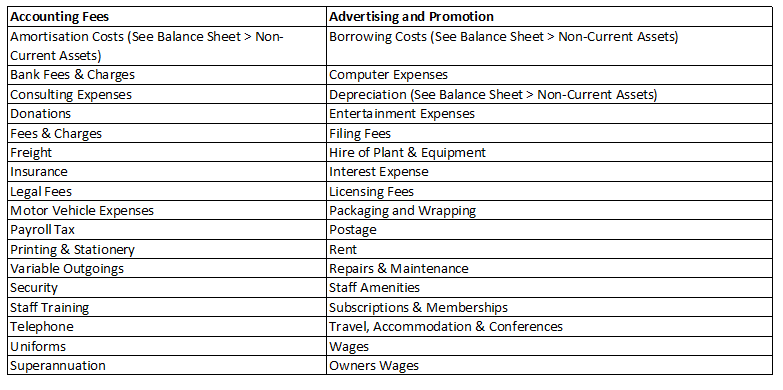

Expenses: These are indirect costs that do not relate to the trading activities.

Common Examples:

Well, that was a lot to learn in such a short period of time! I hope you have found this basic guide enlightening and are a bit more well informed so that the next time you are presented with a set of financial statements, you are able to understand the lingo and what it really means.

If you found this article interesting and want to learn more about being more business minded, why not check out our previous blogs:

1. End of Year Compliance: https://www.peakstrategies.com.au/peak-strategies/compliance-desk-victoria-le

2. Managing your Pharmacy With KPI’s: https://www.peakstrategies.com.au/peak-strategies/2019/8/27/managing-your-pharmacy-with-kpis

Written by our Senior Manager Victoria Le